Whereas Social Finance, often known as SoFi, began out as a pupil mortgage refinancing firm in 2011, they’ve rapidly turn into a lending powerhouse. Right now, the corporate affords monetary merchandise for quite a lot of wants, from their flagship pupil mortgage refis to non-public loans and even mortgages via the lately launched SoFi Mortgage LLC.

Whether or not you’re looking into this widespread lender for a big dwelling enchancment challenge on the horizon, need to cut back your pupil mortgage repayments, or must cowl medical bills, SoFi has you coated. They even provide funding administration and life insurance coverage choices nowadays–in the present day, although, we’re solely going to speak about loans.

SoFi’s choices and charges are very aggressive, and the corporate makes it simpler than ever to handle your borrowing. Let’s check out precisely what SoFi has to supply, the options concerned with every sort of mortgage, and who this firm caters to in relation to refinancing and lending.

In This Article:

- SoFi Pupil Mortgage Refinancing

- SoFi Private Loans

- SoFi Mortgages

- Is SoFi Proper for Me?

SoFi Pupil Mortgage Refinancing

The primary service that SoFi launched–and the one the corporate is best-known for–is pupil mortgage refinancing.

Their refinancing loans provide to avoid wasting you each money and time in your general compensation and are positively price a glance you probably have painful rates of interest or nonetheless carry a big steadiness.

The method for pupil mortgage refinancing via SoFi is simple, and approval is instant. You possibly can have a call in lower than two minutes once you full the applying on-line, and their course of guarantees to be utterly clear. You possibly can even apply and get your fee choices with out impacting your credit score.

Test-out A few of The Greatest Pupil Loans Refinance Presents With SoFi

The Utility Course of

Making use of for a pupil mortgage refinance via SoFi is fairly simple. You’ll be pre-qualified on-line in two minutes or much less and supplied a refi rate of interest, all with out impacting your credit score.

You’ll want some items of data to start out the rate-shopping course of. This contains your:

- Identify and tackle

- Date of start

- E-mail tackle

When you enter this data, you’ll even be requested so as to add an account password. This fashion, you possibly can check in and resume your software or revisit your refi fee, should you’re not prepared to finish the method in the present day.

Then, you’ll be requested to supply your:

- Citizenship standing

- Homeownership standing

- Highest training degree accomplished and diploma program data

- Annual revenue

- Refinance mortgage quantity requested

When you’ve entered all of this data, you’ll be capable to test your refi fee via SoFi. In case you just like the numbers you see, you possibly can full the method for the mortgage on the spot. Earlier than your mortgage origination is full, SoFi may also pull a tough inquiry in your credit score. That is the primary time that your credit score report will likely be impacted all through the applying course of, although.

If you wish to proceed procuring round for charges or aren’t pleased with what SoFi affords, then no hurt, no foul. You possibly can exit the applying (signing again in to finish it later, should you select) with none affect to your credit score or funds.

Charges

There are not any origination or software charges concerned along with your SoFi pupil mortgage refinance. Nor are there any charges for prepayment. Which means that you probably have further room in your finances–or expertise a money windfall–you possibly can repay your refinanced mortgage a little bit early with none penalty.

The one added prices you will notice along with your refinanced pupil mortgage(s) are, in fact, the charged curiosity on the brand new mortgage.

Curiosity Charges

A pupil mortgage refinances via SoFi is actually rolling quite a few smaller loans into one greater mortgage, in an try to avoid wasting each time and money throughout the compensation. And whereas it can save you some critical money by refinancing via SoFi, you possibly can nonetheless count on to pay curiosity charges over the course of the mortgage.

Your particular person rate of interest will rely on quite a few private components. These embody:

- Your credit score historical past (together with its size, whether or not you could have any damaging studies, and your credit score utilization)

- Your current loans’ compensation historical past (how lengthy you’ve been paying them off, whether or not you’ve struggled to pay the minimal due, and so on.)

- Your revenue

- The compensation size you’re requesting with the refinance mortgage

- Whether or not you’re making use of with a co-signer

Curiosity charges can be found as fixed-rate or variable, relying in your wants and the kind of mortgage compensation you search. Rates of interest are altering on a regular basis, however SoFi at the moment affords charges starting from 3.899% to 7.949% for fixed-rate and a pair of.470% to 7.170% for variable fee loans. Each mortgage sorts provide a 0.25% low cost for signing up for AutoPay. That is particular to pupil loans.

The shorter the compensation time period, the higher your credit score historical past, and the upper your credit score rating, the decrease your rate of interest will likely be. Additionally, you will be capable to see the rates of interest you’re being supplied by SoFi earlier than they pull a tough inquiry in your credit score report.

Who It’s For

SoFi is a superb possibility for refinancing your pupil loans, but it surely isn’t for everybody. Actually, some debtors might have a tricky time getting authorised for a refinance, till they’ve constructed up a stable sufficient compensation historical past.

If you’re a U.S. citizen or everlasting resident and have a credit score rating of not less than 650, you’re invited to use for a SoFi pupil mortgage refinance. A credit score rating decrease than that’s nearly positive to end in a denied software, so you could need to apply elsewhere or work to deliver your credit score rating up previous to submitting an software.

SoFi can also be geared to these debtors who’ve a confirmed historical past of optimistic mortgage compensation. In case you’ve only recently graduated and solely have months–or a pair years–of mortgage funds beneath your belt, you’re much less more likely to get authorised. Spend a while constructing that historical past and whittling down the steadiness if you would like an approval from SoFi.

Loans can be found via SoFi with a minimal of $5,000. In case you owe lower than that in your pupil loans, you gained’t be capable to refinance via the lender.

A pupil mortgage refinance from SoFi can also be best for these debtors who’ve high-interest charges on their loans and need to cut back the time remaining on their mortgage compensation, the quantity they may pay in curiosity, or each. In case you at the moment have loans with cheap rates of interest or are nearly completed paying them off, SoFi won’t do a lot good. Nonetheless, in case you are at the moment paying again loans with rates of interest above 9%, or have 1000’s (or tens of 1000’s) nonetheless owed, you may doubtlessly save your self fairly a bit with SoFi.

Mum or dad PLUS Loans

Mum or dad PLUS loans are a bit difficult in relation to refinancing, as they aren’t all the time in a position to be consolidated into the identical refi as non-public pupil loans. With SoFi, although, you possibly can refinance each your non-public pupil loans and your Mum or dad PLUS loans in a single.

So long as you meet the usual mortgage standards set forth by SoFi, you’ll be capable to refinance your Mum or dad PLUS loans. This contains being a U.S. citizen or everlasting resident, having a job or assure of employment within the subsequent 90 days, holding an affiliate’s diploma or greater from an accredited college, and assembly minimal income-vs-expenses necessities.

Residency Pupil Loans

SoFi has, in recent times, begun providing residency pupil mortgage refinancing, which wasn’t beforehand obtainable. So, in case you are a dental or medical college resident and have not less than $10,000 in pupil loans to repay, you possibly can apply for a SoFi refinance mortgage.

You possibly can have as much as 4 years left in your authorised residency program and nonetheless be eligible to use. You have to be a U.S. resident or everlasting citizen with not less than two years left till your standing expires. You could even have graduated with an MD, DO, DMD, or DDS from sure U.S.-based Title IV accredited universities or graduate packages.

Underwriting necessities nonetheless apply for residency mortgage refinances. Your revenue, bills, employment, and credit score historical past will likely be taken into consideration, which can affect each your approval and the rates of interest supplied.

SoFi Private Loans

You would possibly take into account a private mortgage for quite a few causes. There could be a giant dwelling enchancment challenge on the horizon, you could need to embark on a brand new enterprise enterprise, and even simply plan an thrilling wedding ceremony or household journey. Or, should you’re at the moment paying off high-interest debt (similar to bank card balances), a private mortgage may very well be a solution to each get rid of that debt and cut back your rates of interest on the similar time.

Regardless of the motive could also be for needing a private mortgage, SoFi would possibly be capable to give you the appropriate mortgage on the proper fee… and the method is a bit of cake.

The Utility Course of

The method of making use of for a SoFi pupil mortgage is fast and straightforward. Identical to the scholar mortgage refi above, the non-public mortgage software course of could be accomplished on-line in mere minutes, all with out impacting your credit score.

When making use of on-line, you’ll want to supply a couple of items of private data. This contains your:

- Identify

- State of residence

You’ll then be requested so as to add a password, in an effort to revisit your mortgage software (and provide) afterward.

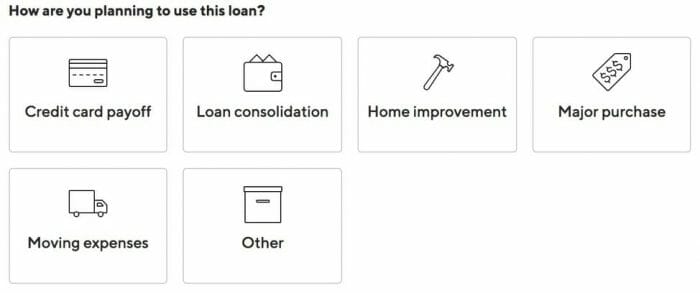

Subsequent, you’ll must let SoFi understand how a lot you need to borrow and why. Private loans can be found in quantities starting from $5,000 all the best way as much as $100,000, relying on whether or not you qualify.

Give it a Attempt! Finance Your Objectives With SoFi Now

You’ll additionally want to provide your date of start and citizenship standing. Subsequent up is your private data–your tackle and cellphone quantity, whether or not you’re renting or personal your private home, your annual revenue, whether or not you’re making use of with a cosigner, and an acceptance of SoFi’s phrases.

SoFi will then run a tender pull in your credit score to find out eligibility and give you a fee. This gained’t affect your credit score in any respect. In case you select to just accept the provide and proceed with the mortgage, although, they may also conduct a tough pull (which can present up in your credit score report).

Charges

There are not any origination or software charges with SoFi private loans. You additionally gained’t encounter any charges for prepayment. Which means that should you select to repay your mortgage early for any motive, you gained’t be penalized for doing so.

The one charges you’ll encounter with a SoFi private mortgage are your curiosity prices.

Curiosity Charges

As with all loans, rates of interest will differ relying on the mortgage requested and your individual private creditworthiness. As of this writing, SoFi’s private mortgage rates of interest differ from 6.54% to fifteen.49% APR. A reduction of 0.25% can also be obtainable for these debtors enrolling in AutoPay.

Your individual private mortgage’s rate of interest will rely on:

- The mortgage quantity requested

- The explanation in your mortgage

- Your private credit score historical past

- Your revenue versus your month-to-month bills (money circulate)

- Whether or not you could have a cosigner

- Your credit score rating

- The mortgage compensation time period you request

The higher your credit score, the upper your credit score rating, and the shorter the mortgage compensation you select, the higher your fee will likely be. Including a cosigner can even assist decrease your fee, as can signing up for AutoPay.

Who It’s For

As with all SoFi loans, you’ll have a greater probability at approval you probably have a stable credit score historical past and revenue.

SoFi candidates are required to have a credit score rating of not less than 650, with the typical borrower having a rating of 700+. SoFi additionally appears at your money circulate, versus solely taking a look at your revenue. So you probably have excessive bills every month and never a lot wiggle room in your finances, you might need bother getting authorised.

SoFi Mortgages

SoFi won’t be the primary lender you consider when shopping for a brand new dwelling, however their mortgage choices are fairly attractive. For instance, you may get a house mortgage as much as $3,000,000, for as little as 10% down… and, you don’t even have to fret about PMI.

The Utility Course of

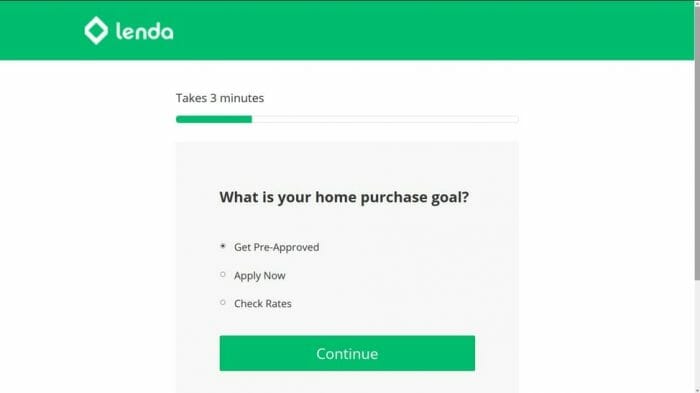

Whether or not you’re already house-hunting or simply need to know what you possibly can afford, SoFi could make the applying course of straightforward.

You will get pre-approved in your subsequent mortgage on-line in as little as two minutes, with none affect to your credit score. SoFi’s straightforward on-line software may also give you charges and mortgage phrases, so you realize precisely what you’re taking a look at with your private home buy

To start out, go to SoFi’s web site and begin a house mortgage software. You’ll want to supply your:

- Identify

- E-mail tackle

- State of residence

You’ll even be requested to create a password. That manner, you possibly can revisit your software or full the mortgage course of afterward, if wanted.

Subsequent, SoFi will ask you in your:

- Handle

- Cellphone Quantity

- Date of start

- Citizenship standing

- Whether or not you hire or personal your private home

- Acceptance of SoFi’s phrases

- Training information

- Revenue

- Employment historical past

The following step is your mortgage eligibility. For this step within the course of, SoFi needs to know:

- Whether or not you’re shopping for a brand new dwelling or refinancing your current dwelling

- The property sort

- The occupancy

- The place you might be within the course of

- County and state of the property

- Home-owner’s dues

- Marital standing

- What you propose to do along with your main residence

- Variety of occupants within the new dwelling

- Co-applicant information (if relevant)

When you submit all of this data, you’ll be supplied charges and a pre-approval. You possibly can select the mortgage compensation phrases that the majority enchantment to you, in addition to your down cost desire.

This can end in a tender pull in your credit score, which gained’t affect your report in any manner. Nonetheless, should you proceed with the mortgage, SoFi may also conduct a tough pull, which can present up in your credit score report.

Charges

There are not any software or origination charges concerned with SoFi mortgage loans.You additionally gained’t encounter any charges for mortgage prepayment. Which means that if you wish to repay your mortgage early, you gained’t be penalized.

The added prices that may very well be concerned with a SoFi dwelling mortgage embody:

- A down cost (as little as 10%)

- Property appraisal

You’ll additionally pay further charges for curiosity prices over the lifetime of the mortgage.

Curiosity Charges

As with all mortgages, SoFi rates of interest can differ fairly a bit from one applicant to the following. They’re calculated primarily based on quite a few components, together with your credit score historical past, credit score rating, revenue and month-to-month bills, whether or not or not you could have a co-signer, your chosen mortgage phrases, your down cost, the loan-to-value ratio of your private home, and your employment standing.

Rates of interest change on a regular basis. At the moment, although, SoFi affords 15- and 30-year mortgage phrases, in addition to 7/1 ARMs and 5/1 ARM Curiosity-Solely loans. Charges vary from 4.716% to five.249% APR.

Who It’s For

There are a couple of nice causes to decide on SoFi in your dwelling mortgage, in addition to a couple of causes to look elsewhere.

SoFi could be an excellent place to use in your subsequent dwelling mortgage if you wish to:

- Get pre-approval that doesn’t affect your credit score rating

- Purchase a house with a price ticket of as much as $3,000,000

- Need the flexibleness of a down cost as little as 10%, with out PMI

- Need approval in as little as 2 minutes

- Have a credit score rating of not less than 650 (ideally 700+)

- Shut in your new mortgage in lower than 30 days (on common)

Nonetheless, you probably have a less-than-desirable credit score historical past, have money circulate issues every month or an unstable employment standing, should not a U.S. citizen or everlasting resident, or are looking to buy a rental property, SoFi isn’t the place for you.

Mortgage Refinance

To refinance a mortgage via SoFi, the applying course of is an identical–you’ll merely select “refinance my current dwelling” on the third web page of the applying, as a substitute of “purchase a brand new dwelling.”

Refinanced mortgages can be found to debtors with not less than 20% fairness of their dwelling. Additionally they provide a cashout refinance, if you wish to use your private home’s fairness for dwelling enhancements, to repay different money owed, or for a giant buy.

The Home of Your Desires? Make Your Dream Come True With SoFi

Is SoFi Proper for Me?

It doesn’t matter what sort of mortgage you’re searching for, give SoFi a glance. You’ll discover pupil mortgage refinancing, mortgage loans, mortgage refinancing, and even private loans–all fee-free. Greater than that, although, you may get your charges and a pre-approval provide with out impacting your credit score.

SoFi doesn’t have pretty strict pointers concerning borrower’s credit score and money circulate. You’ll need to be sure that you don’t have damaging studies in your credit score and a rating of not less than 650, although 700+ is right. Additionally, your income-vs-expenses ratio is much more necessary than your revenue alone, though the typical SoFi borrower has an revenue of not less than $100,000.

Charges via SoFi are very aggressive and phrases are versatile, providing you loans that meet your wants with out charges or pointless bills. Plus, the applying course of takes about two minutes to finish.

If you wish to study extra about SoFi merchandise or apply for a mortgage, you are able to do so right here.

,