In case you are searching for a private mortgage, you perceive the frustration that the method can carry. You’re sometimes pressured to sift by means of varied lenders to not solely discover the one that may approve your request and meet your necessities, but additionally snag the mortgage with the bottom charges. It may be time-consuming and also you may not even come throughout the lender that will be finest for you.

That’s the place Even Monetary comes into play.

Even Monetary is a private mortgage combination web site, which has got down to join potential debtors with their supreme lenders. Not solely will you be linked up with banks providing the mortgage varieties, quantities, and phrases that you simply want, however you’ll even have the prospect to price store varied lenders earlier than committing to 1… multi functional place.

One of the best elements? There isn’t any influence to your credit score till you choose your lender and determine to maneuver ahead with the mortgage, and Even Monetary’s service is solely free.

Let’s check out precisely what Even Monetary does, and whether or not this lender-comparing web site is true in your subsequent private mortgage.

In This Article:

- Options

- Pricing

- The Course of

- Safety

- Buyer Service

- Execs and Cons

- Various

- Is Even Monetary Proper for You?

- Abstract

Options

There are lots of causes to search for a private mortgage. You may wish to fund an thrilling journey or large buy, repay a high-interest bank card, refinance different loans, or make enhancements on your own home. Irrespective of the rationale, although, purchasing round generally is a ache.

Even Monetary seeks to make your complete course of simple and fast, by providing you with entry to dozens of lenders and aggressive charges, whatever the actual mortgage you want.

Private loans can be found in quantities starting from $1,000 all the best way as much as $100,000. You can too seek for mortgage reimbursement phrases anyplace from two years to seven years, relying on how lengthy you want, and charges begin as little as 4.99% APR. Irrespective of your search phrases, you’ll be related with lenders that meet your standards and have essentially the most aggressive charges obtainable.

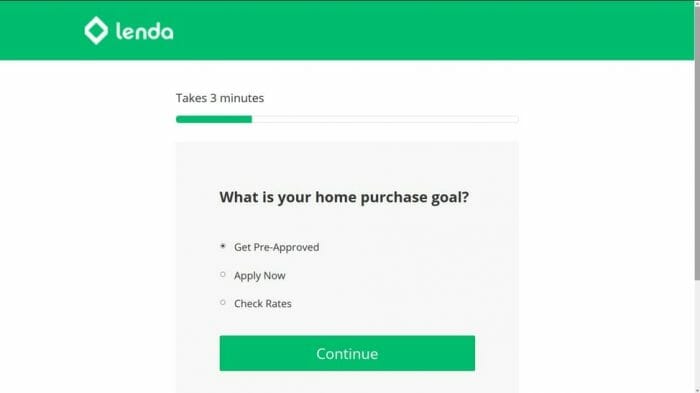

The mortgage search not solely takes lower than 3 minutes, nevertheless it additionally gained’t have an effect on your credit score. Even Monetary will conduct a smooth inquiry in your credit score in an effort to give you essentially the most relevant charges. Nevertheless, you gained’t truly see any influence in your credit score historical past till you select a lender and proceed with finalizing your mortgage.

You’ll get presents from common lenders together with LendingClub, Prosper, Greatest Egg, and SoFi. You’ll even have an opportunity to view presents from different small companions, who you might need by no means come throughout with out an aggregator like Even. Relying in your credit score historical past and your mortgage wants, the charges and phrases provided could range.

In fact, the most effective elements of utilizing Even Monetary to seek for your subsequent private mortgage is the truth that it’s solely free.

Mortgage Refinancing

You need to use Even Monetary to refinance an present mortgage, too, albeit not directly.

When first making use of by means of Even, you’ll be requested the aim of your private mortgage. Merely select “debt consolidation” for those who plan to refinance a number of present loans together with your new private mortgage.

Pricing

There aren’t any charges concerned with utilizing Even Monetary. Your solely added bills will come within the type of rates of interest, which will likely be decided–and charged–by your chosen lender.

Your rate of interest will likely be contingent in your private credit score historical past, the mortgage specifics requested, and your reimbursement phrases.

The Course of

It’s fast and simple to cost out private loans by means of Even Monetary. Your entire course of took me lower than a minute, and I had numerous presents posted proper after clicking Submit.

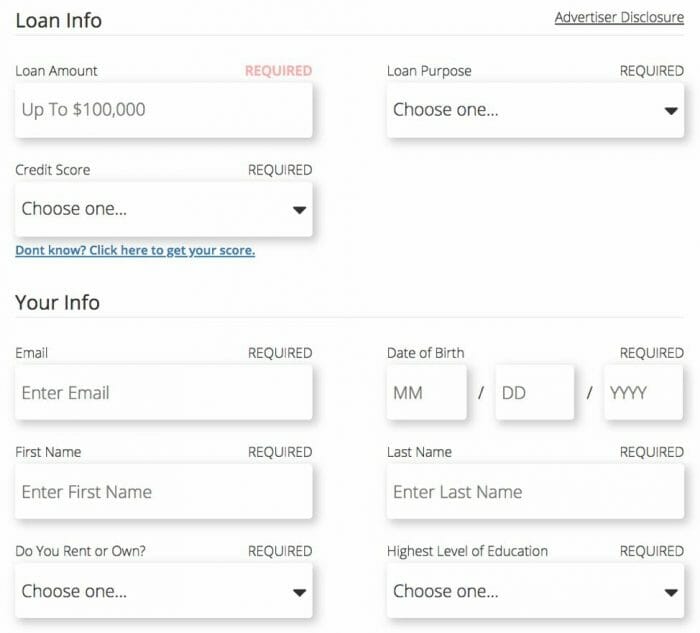

First, you’ll have to enter the small print for the mortgage you need. This contains the quantity you’re trying to borrow, why you wish to borrow it, and your present credit score rating vary. Even Monetary will confirm this with a smooth credit score pull, although it would don’t have any influence in your credit score till you proceed together with your chosen lender.

Subsequent, you’ll be requested to enter your private data, together with your title, handle, date of start, cellphone quantity, whether or not you personal your own home, and your schooling historical past.

You’ll want to just accept Even Monetary’s phrases after which click on Undergo have your mortgage request shopped by means of the lenders who companion with Even. This search took about 20 seconds, and I had 4 presents obtainable to me instantly after.

Give It a Attempt Now: Evaluate Customised Private Loans/Refinance Gives With EVEN

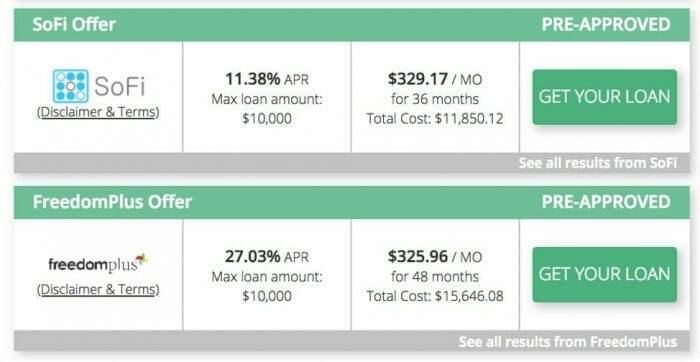

The outcomes will present you which of them lender is providing a mortgage to match your phrases, in addition to their proposed rate of interest. You’ll additionally see how a lot your month-to-month fee will likely be and the entire price of your mortgage if it’s paid based on schedule on the price proven.

I didn’t discover immediately, however there was a “See Extra Gives” button on the backside of my lender outcomes. As soon as I clicked on that, two extra lender presents popped up, bringing my complete to 6 lenders.

If any of your outcomes pique your curiosity, you may click on on Get Your Mortgage to start the finalization course of. It will direct you to the lender’s personal web site, the place you’ll enter further data. The lender you select can even run a tough inquiry in your credit score as a part of the finalization course of.

Safety

Even Monetary understandably requests fairly a little bit of your private data in an effort to present tailor-made mortgage presents. And contemplating the prevalence of IT hacks and the sale of private information today, this generally is a bit unnerving.

In accordance with Even Monetary’s privateness coverage, they make an effort to guard any of your data that you simply submit by means of the positioning. In fact, no digital transmission is solely foolproof and knowledge theft is all the time a chance. Even Monetary will notify you if a breach happens which will influence your data.

They declare that they won’t promote your data, although they may “share” information that you simply present with their “companions,” whose merchandise could also be of curiosity to you. I’ll say that inside 30 seconds of clicking Submit for my mortgage request, I obtained a name on my cellphone. It was from a quantity in my residence state so, despite the fact that I didn’t know the caller, I picked up.

It was a mortgage providers firm who recognized as an Even Monetary companion, providing me a mortgage various to assist me with my monetary wants. Despite the fact that the mortgage I utilized for was for $10,000, the caller claimed that he may provide me as a lot as $25,000 if I wanted it.

Actually, it felt somewhat uncomfortable to me, particularly for the reason that name occurred actually seconds after my data was submitted to Even Monetary. Whereas the lender calling might need been a superb possibility for my monetary wants, I used to be postpone by the obviously-instant transmission of my data to a “companion” firm.

Buyer Service

If you happen to need assistance from Even Monetary, your choices are a bit restricted. You might be welcome to contact the corporate by way of e mail, and thru a contact type on their website. Nevertheless, there aren’t any reside chats obtainable, and I used to be unable to discover a cellphone quantity to assist me with any questions I might need had.

Fortunately, most of your questions will most likely be directed to the lender you select. Relying on which mortgage give you go together with, you need to be capable to attain them instantly.

Execs and Cons

In case you are searching for a brand new private mortgage, Even Monetary might be value a glance. The positioning could make your search quicker and simpler, offering you with numerous presents in mere seconds.

When trying to find a mortgage by means of Even, you will get presents for loans starting from $1,000 to $100,000 in dimension, assembly no matter monetary wants you’ll have. You can too store round with none influence to your credit score, getting pre-approved for loans of varied phrases and with a spread of rates of interest, all with none dedication or detrimental influence.

Utilizing Even Monetary was fast and simple. I used to be capable of fill out the appliance and get outcomes from lenders in lower than a pair minutes’ time. It was positively quicker than visiting every of the large lenders’ web sites instantly and filling out all the similar data in duplicate.

There are just a few downsides to utilizing this private mortgage aggregator, although.

First, you’re restricted to mortgage presents from the lenders that already companion with Even Monetary. Whereas this checklist is rising on a regular basis, you may additionally miss out on an organization although may provide a greater price or phrases which are much more supreme in your wants.

I used to be a bit miffed to note a “See Extra Gives” button tucked away beneath my featured 4 presents, too. I didn’t see this the primary time I appeared and, had I not ultimately seen it, I wouldn’t have discovered two different presents obtainable to me. One among them was truly the bottom rate of interest of the entire checklist of six (from SoFi), making me query why it was hidden.

Maybe sure lenders are featured above others, however it will have been good to have the perfect mortgage for me on the high of the checklist, reasonably than hidden. The highest mortgage on my checklist was truly the most costly of all of the choices!

The opposite draw back is that Even Monetary clearly shares your data with companion lenders. Clearly, that is the case when offering you with the mortgage presents featured in your outcomes, however your private data can even be shared with lenders who will solicit you. The cellphone name that I obtained 30 seconds after making use of is proof of this, and was a bit off-putting.

Various

There are many different private mortgage aggregators to select from, for those who’re searching for a brand new private mortgage. They’re all very related in options and the lenders that they work with, they usually all use your data in roughly the identical means.

Another private mortgage aggregator corporations embody Credible and PickALender.com. You can too submit your mortgage preferences on a peer-to-peer (P2P) lending website and have particular person lenders “bid” to fund your mortgage.

If in case you have an thought of the lender you’d choose to work with, you may as well apply in your mortgage by means of their website instantly. A few of our favourite lenders embody SoFi, Greatest Egg, and LendingClub.

Is Even Monetary Proper for You?

If you happen to’re trying to take out a private mortgage, you’ve gotten numerous choices. Whether or not you’re trying to take a trip, make a giant buy, repay high-interest debt, consolidate different loans, and even cowl upcoming medical/dental payments, you wish to choose a mortgage with the bottom rate of interest. Plus, you want a lender who presents reimbursement phrases that suit your funds.

Even Monetary may help you discover the perfect lender in your wants, multi functional place. You’ll be matched up with numerous totally different corporations, all competing for what you are promoting. You’ll see charges and reimbursement totals, and it gained’t influence your credit score to get these quotes.

Whether or not you want a mortgage from $1,000 to $100,000, and need phrases starting from two years to seven years, Even Monetary can join you with the suitable lenders. Outcomes solely take about two minutes to get, too, making it each simple and quick.

Evaluate Aggressive Private Loans/Refinance Gives With EVEN Monetary

Abstract

The following time you’re purchasing round for a private mortgage, don’t waste time visiting particular person lender web sites for charges. By testing Even Monetary first, you’ll get charges from a few of the main lenders available in the market– like Prosper, LendingClub, SoFi, and Greatest Egg–with one fast utility.

You’ll additionally keep away from any detrimental influence in your credit score by rate-shopping with Even. The smooth inquiry they’ll pull doesn’t have an effect on your credit score report, however nonetheless permits you to get pre-approved for a few of the finest loans.

To be taught extra about Even Monetary, or begin purchasing in your subsequent private mortgage, go to their web site right here.

,