If you’ve ever applied for a mortgage in the past, and you’ve been overwhelmed by the length of time the process takes, and the incredible amount of documentation required, you should check out Lenda. It’s an all online mortgage lender, that allows you to complete the loan application process in a matter of minutes, and submit necessary documentation with the push of a button. It’s a real opportunity to streamline the otherwise cumbersome mortgage process.

In This Article:

- What is Lenda?

- How Lenda Works

- Lenda Features and Benefits

- The Lenda Application Process

- What Separates Lenda from the Competition?

- Lenda Pros & Cons

- Should You Get Your Mortgage with Lenda?

What is Lenda?

Lenda is an online mortgage service dedicated to streamlining the application process, and to providing affordable home financing. Launched in 2014, the company’s mission is to Reimagine Homeownership. By that they mean the loan process should be quick, transparent, and deliver financing at the lowest possible price.

Like so many online platforms, Lenda attempts to improve on the mortgage application process by automating it through technology. It enables you to get rate quotes immediately, then to evaluate your application should you decide to proceed. What’s more, the emphasis on technology eliminates much of the paperwork burden commonly associated with the mortgage application process.

But Lenda isn’t 100% technology. You’re also assigned a dedicated Home Loan Advisor who helps you throughout the process. Heavy emphasis on technology–and away from buildings and staff–enable Lenda to lower costs associated with applying for a mortgage. But they still make human assistance available whenever you need it.

Lenda operates in the following states: Arizona, California, Colorado, Florida, Georgia, Illinois, Michigan, Oregon, Pennsylvania, Texas, Virginia, and Washington. They also indicate they’re looking to expand into other states.

Your State is on The List? Compare Mortgage Offers With Lenda Now

How Lenda Works

Eligible Borrowers

Lenda can accommodate salaried borrowers, the self-employed, and those who own multiple properties (up to six properties).

Property Types Financed

Lenda has mortgages available for both residential purchases and refinances. They can also provide financing for investment properties. However, they do not provide financing for commercial properties, or for manufactured or mobile homes.

Available Loan Types

Conventional loans (through Fannie Mae and Freddie Mac), but not adjustable-rate mortgages, or secondary financing (second mortgages or home equity lines of credit). Lenda also does not offer FHA or VA loans.

Loan terms available are 15 years and 30 years, both fixed rate mortgages. Cash out refinances are available as either rate and term, or cash-out mortgages.

You can apply for either a pre-qualification or a preapproval. A pre-qualification is where the lender confirms your loan eligibility based on self-reported information on credit, assets, and income. A preapproval is a much stronger outcome. That’s where you supply the documentation needed to support the loan decision. Naturally, a pre-approval is much closer to a final approval than a prequalification.

Lenda claims it usually takes 30 days or less to complete the mortgage process for either a purchase or refinance. However, they can accommodate shorter time frames if you make a request.

Loan Servicing

Lenda funds and closes your loan, however, they do not service mortgages. You’ll be notified who and where to make your monthly mortgage payments to after the closing. This is a typical practice in the mortgage industry; a loan originated by one company is serviced by another. And during the term of your loan, it’s likely the servicing will be transferred several times.

Lenda Features and Benefits

Lenda provides all the tools you need to get the mortgage you want.

How Do Mortgages Work Tutorial

The Lenda website offers this program as “The Essential Home Mortgage Guide to Get a Home Loan for First-Time Buyers”. If you’ve never purchased a home before, the guide will walk you through the process. It’s a multistep process that will help you:

- Choose a mortgage and apply for a loan.

- Understanding the home inspection and locking your interest rate.

- The appraisal and insurance for the new home.

- The closing process.

The guide will walk you through the entire process, helping you to know how much house you can afford to buy, as well as the documentation required for the mortgage application process.

Lenda Refinance Calculator

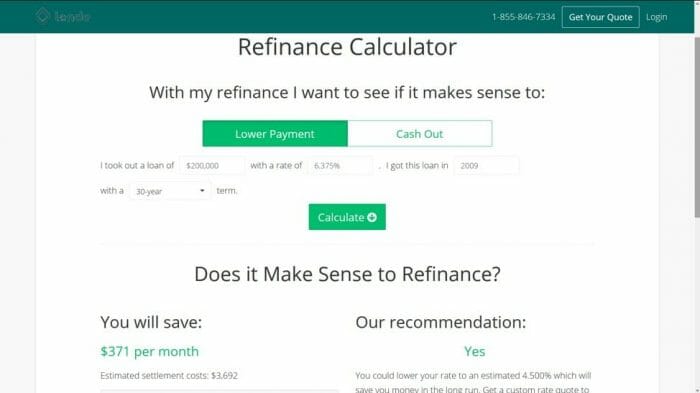

The decision to refinance your home can be a complicated one. This is particularly true if the difference between your existing interest rate and a new one is relatively small. You must take into consideration not only the savings in your monthly payment, but also the closing costs on the new loan, and how long it will take to recover those costs.

The Lenda Refinance Calculator can help you answer all those questions. It’ll tell you exactly how much you will save on your monthly payment, based on current interest rates, as well as the closing costs involved in the transaction. You’ll get a direct recommendation as to whether or not you should proceed with the refinance.

Customer Service

You can contact Lenda by phone, email, text, or online chat. Customer service is available Monday through Friday, 9:00 AM to 5:00 PM, Pacific time.

Lenda Security

Lenda uses a multilayered security system to protect your information. At their facilities, they have security guards, building access badges, and a video surveillance system to protect the computing infrastructure from unauthorized access. They use administrative safeguards like security training programs and employee background checks.

The transmission of information is protected by industry standard encryption and the use of Secure Socket Layer (SSL) technology to create encrypted connections between web browsers and in-house servers. Lenda also implements a session timeout after 45 minutes of inactivity on their website.

Lenda Pricing and Fees

There is no application fee required, nor must you pay for your credit report. You will need to pay an appraisal fee, but that won’t be required until you are well into the application process. The appraisal fee is nonrefundable, once the appraisal has been ordered and completed.

Interest rates are consistent with the daily pricing levels provided by Fannie Mae and Freddie Mac for all lenders.

Interest Rate Buydowns

Lenda gives you the opportunity to lower your interest rate by paying discount points. Each point equals 1% of your mortgage amount, and will generally lower your interest rate by 1/8 of a point (.125%). For example, paying 2 discount points will lower your interest rate from 4.5% to 4.25%.

It’s an expensive way to lower your interest rate, but it may be worth doing if a third party will be paying the discount points. This can be the property seller, your employer, or even a gift from a relative.

Lenda Credit

If you refer family, friends or colleagues to Lenda, you’ll be eligible to receive a $500 Lenda Credit. This is a credit that will used toward your own fees with your Lenda mortgage application.

The Lenda Application Process

Give It a Try Now: Compare Customised Mortgage Offers With Lenda

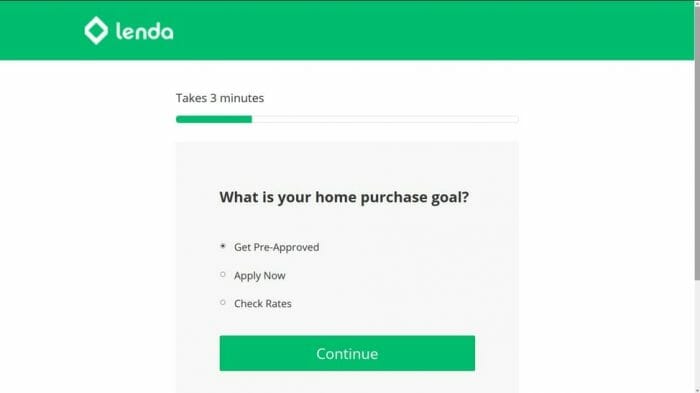

The Lenda application process takes place entirely online. You can complete the application in just a few minutes. It starts with entering your email address, then creating a password. It will then take you through a series of screens that will ask you questions in regard to your personal information, income and employment, assets, credit, and other necessary information for a mortgage loan application.

Once you submit your completed online application, it will be reviewed, and you’ll hear back within one business day.

Your credit report will be pulled, but you will not have to pay a fee for the report.

Tax transcripts from the IRS will verify your income. This is usually done by having you complete IRS Form 4506, Request for Transcript of Tax Return.

Once you hear from your appointed Home Loan Advisor you will have an opportunity to lock your interest rate. You will receive confirmation of the lock within 24 hours. Loan locks are typically good for 45 days.

You’ll be provided with estimated fees and closing costs when you click “See Rate Details” on the Rate Quote Page. These will be a close approximation, based on available information, but final numbers may vary somewhat by closing (this is typical in the mortgage application process).

Documentation Submission

If you’ve ever applied for a mortgage in the past, then you’re well aware that it’s a paperwork intensive process. But since all documentation can be submitted to Lenda online, the documentation process is greatly streamlined.

You probably already have certain documents, like bank statements, retirement statements, pay stubs, W-2s, and even tax returns stored on your computer. All you need to do is upload them into the Lenda app, and you’ll be done. Even a purchase contract can be downloaded or emailed, if a copy has been forwarded to you by the real estate agent. Anything that’s available on your computer, or web accessible, can be scanned and submitted.

This will eliminate the need to obtain files full of documents, copying them, then mailing them out to the mortgage lender.

What Separates Lenda from the Competition?

One of the main factors separating Lenda from the competition–or at least from the mortgage aggregators–is that the company is a direct lender. That is, they not only process your loan, they also fund it.

The use of dedicated mortgage personnel also gives them an advantage. There are some online lenders who are attempting to move toward a complete technical solution. But Lenda uses real people–Home Loan Advisors–to help guide you through the process. This is a big advantage, because the documentation and legal requirements of the mortgage industry make it at least somewhat technology resistant. Lenda works around this by using a good blend of technology and human assistance.

Finally, there’s the documentation advantage. You can upload required documents to the Lenda platform in a matter of minutes. While traditional mortgage lenders are trying to move in this direction as well, Lenda is already there.

Lenda Pros & Cons

Pros:

- Lenda enables you to complete the mortgage application process in a matter of minutes, and from the comfort of your home or office.

- You can download needed documentation from your computer, get information from third-party sources on the web, or scan any other documents necessary.

- You’ll be appointed a Home Loan Advisor who will add the human touch to an otherwise online experience.

- Lenda has a wealth of educational resources and calculators to help you make the right mortgage decision.

- You can check rate scenarios, run loan calculations, get prequalified, or go for a full mortgage approval.

Cons:

- Lenda is available in only 12 states.

- Mortgages available are conventional only, as they do not provide FHA and VA mortgages.

- They do not provide adjustable-rate loans or secondary financing (second mortgages and home equity lines of credit).

- Customer service is available on Pacific time. That means if you live on the East Coast, you won’t be able to contact Lenda before noon. On a positive note, they will be available until 8:00 PM, Eastern time.

Compare Mortgage Offers With Lenda Now

Should You Get Your Mortgage with Lenda?

The answer to this question really depends on the type of loan you plan to apply for, and your overall income situation and credit profile. For example, if you’re a veteran, and want to apply for a VA mortgage, Lenda does not have this loan type available. The same is true for FHA loans, which are good for those with less-than-perfect credit. However, Lenda does not provide FHA mortgages.

But if you’re looking for conventional financing, either to purchase or refinance, Lenda can be a good choice. The mortgage lending process is really the same from one lender to another. But what Lenda does is expedite the process through the all-online application. You can complete the application in a matter of minutes, download necessary documentation with ease, and complete the process in the shortest time possible.

One other situation we did notice in running rate scenarios is that the interest rate tends to be lower on higher loan amounts. For example, when we ran a $200,000 loan amount, we got a rate of 4.50%. But when we ran $400,000, the rate came back at 4.25%. That could indicate Lenda provides more advantageous pricing to higher loan amounts.

If you’d like more information, or if you would like to apply for a mortgage, visit the Lenda website to get started.

,